5 Most important EU Rules and Regulations for Maritime Industry

FuelEU Maritime / EU ETS / AFID / RED / ETD

Summary - As a shipowner, you will be required to pay a carbon tax of €200-€300 per mT fuel, implement shore power, and use low carbon fuels by 2024-2030. Create a mitigation plan now by contacting the helpdesk for assistance.

RED targets supply side - production - of fuels in the EU, aiming for a 40% energy share from renewable sources by 2030.

AFIR targets the supply side of marine infrastructure and fuels in the EU, mandating the use of low-carbon fuels and shore power by 2030.

FuelEU Maritime is one of the most stringent upcoming laws on maritime sustainability, enforcing strict fuel reduction targets in combination with penalties on fuel combustion and shore power obligations for container and passenger ships.

EU ETS will serve as a carbon tax for the maritime industry. At current price level, it will increase fuel cost by at least €200 - €300 per mT fuel.

This blog briefly highlights key rules and regulations for EU as per January 2023. Contact the helpdesk to clarify any questions.

EU has shipping in its sights

The European Union is one of the leading governments when it comes to sustainability ambitions. They recognize that maritime transport plays an essential role in the EU economy and is one of the most energy-efficient modes of transport, but also that it is a growing source of greenhouse gas emissions. Emissions are projected to increase from 90% to as much as 130% of 2008 by 2050. At EU level, maritime transport represents 3 to 4% of the EU’s total CO2 emissions.

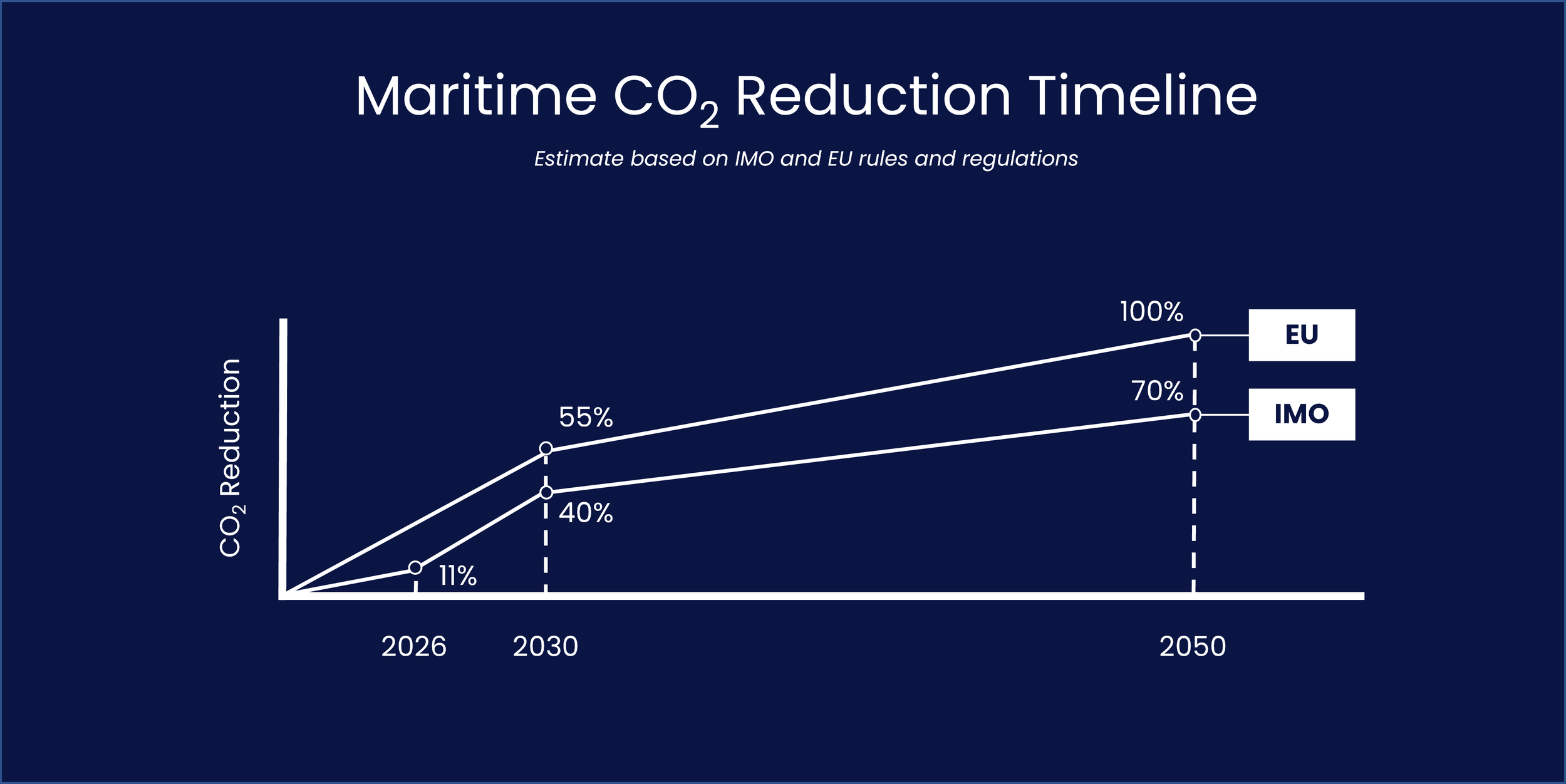

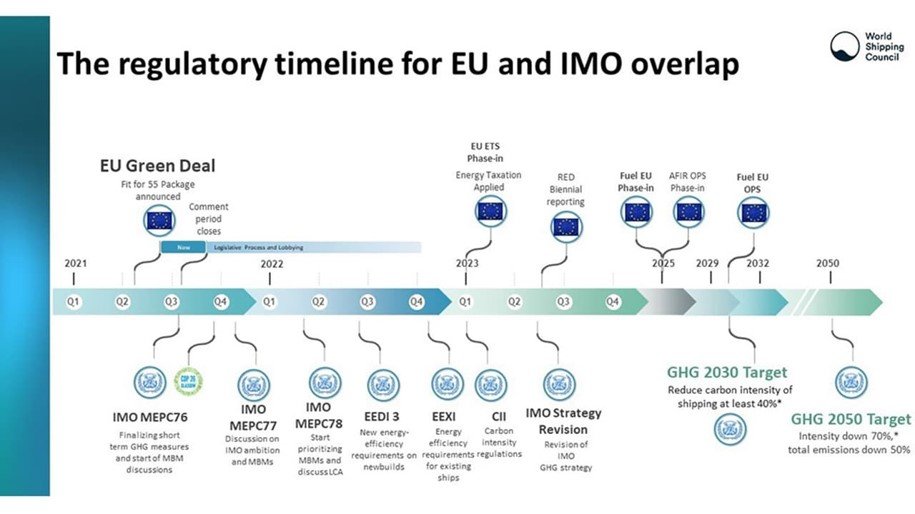

The relatively slow progress in the IMO has triggered the EU to take action and make new proposals to make sure maritime transport plays its part in achieving climate neutrality in Europe by 2050. This started in 2013, when the Commission set out a strategy towards reducing emissions from the shipping industry. In 2019, the European Green Deal was signed to ensure the EU achieves 55% reduction of emissions by 2030 compared to 1990 levels.

The EU has consistently pushed for higher environmental ambitions than the IMO and is in all regards more stringent than IMO legislation. Especially the last two years have seen an acceleration of decarbonization legislation, exemplified by the European Climate Law and Fit for 55 package.

European Climate Law

One of the core elements of the European Green Deal is the European Climate Law. A provisional agreement on this Climate Law was reached on April 21, 2021. The European Climate Law outlines a framework for the irreversible and gradual reduction of greenhouse gas emissions and legally establishes the goal of a climate-neutral Europe by 2050.

The European Climate Law does not define precisely which measures member states need to make, but it does define what should be taken into account when adopting concrete rules and regulations. One example is the competitiveness of the EU economy (i.e. the level playing field), and the best available techniques for decarbonization. Furthermore, it states that member states must prepare and implement adaptation strategies and plans. The European Climate Law also introduces measures for monitoring progress. Every five years, the European Commission will evaluate the collective progress and the measures available, and, if necessary, will take action.

Fit for 55

On July 14 2021, the European Commission adopted the Fit for 55 package, a roadmap that explains how the EU intends to reduce its net greenhouse gas emissions to 55% by 2030. This legislative package comprises a dozen revised and new pieces of legislation on multiple different topics (energy efficiency, renewables, transport, emissions trading and reduction, etc.), to reach the CO2 reduction targets of 55% below 1990 levels by 2030. Fit for 55 affects all industrial sectors – including shipping – in particular with the above mentioned legislation.

References

EU - Reducing emissions from the shipping sector

EU - Review of EU ETS

Stibbeblog - The European Climate Law explained

The Port of Marseille, headquartering CMA CGM, committed themselves, by signing a Blue Charter, to respecting rules that are much more stringent than national and international regulations. These include the use of shore power from 2025 for ships fitted with the equipment.

The Global Pricing Dashboard made by the World Bank is one of the most complete overviews carbon pricing initiatives worldwide. 23.17% of all global greenhouse gas emissions were covered in 2022. Only EU ETS aims to incorporate shipping emissions at the moment, others are expected to follow suit.

One of the most stringent ports in the world regarding shore power, which is mandatory by 2027 for all vessels by authority of CARB.

China officially aims for carbon neutrality “before 2060”. With legislation on carbon tax and fuel specifications upcoming but not yet active in the foreseeable years, main focus has been on the development of shore power infrastructure but the technology remains under-utilized in ports in the country.

Learn more about the targets, ambitions and upcoming rules and regulations of the Netherlands with regards to maritime sustainability here.

IMO aims for 11% carbon intensity reduction per 2026, 40% in 2030 and 70% reduction in 2050. MARPOL and MEPC are key regulatory bodies within IMO. Virtually all rules and regulations apply to vessels of 5.000 GT and above. The most important rules and regulations for shipowners to comply with are SEEMP (includes DCS and CII), EEXI/EEDI and Emission Controlled Areas (ECAs).

IMO Net-Zero Framework - similar to a carbon tax - under MEPC 83, from 2028 onwards for ships above 5,000 GT

Cruise ships capable of accommodating more than 100 passengers in Sydney Harbour are required to limit emissions of sulphur oxides when berthing (maximum 0.10% m/m). It is like a mini-ECA in Sidney waters. Learn more here.

China’s coastal shipping sector is to implement low-carbon marine fuel regulations no later than 2030. Learn more about the low-carbon fuel regulations in China here.

China’s national ETS – the world’s largest in terms of covered emissions – started operating in 2021. Shipping is not included, for the moment. Learn more about ETS here.

Emissions from cruise ships and ferries in World Heritage Fjords are to be zero by 2026 latest. Read more here.

The ETD is the principal taxing scheme used for fossil and low-carbon fuels in EU. Fossil fuels will be taxed more, and renewable low-carbon fuels will receive incentives, including shore power.

RED targets supply side - production - of fuels in the EU, aiming for a 40% energy share from renewable sources by 2030.

AFIR targets the supply side of marine infrastructure and fuels in the EU, mandating the use of low-carbon fuels and shore power by 2030.

EU MRV is the CO2 reporting system in Europe, used for carbon tax determination. It is applicable to vessels of 5000 GT and above. It is expected to apply to 400 GT and above. Learn more about EU MRV here.

ECAs (Emission Control Areas) are sea areas that limit SOx or NOx emissions. Currently there are several ECAs active in North America and Europe. Learn more about ECAs here.

For ships operating outside Emission Control Areas (ECAs), the limit for sulphur content of fuel oil is 0.50% m/m (mass by mass). Learn more about the global sulphur limit for shipping here.

Learn all about the sustainable ambitions of the Port of Singapore, in particular with regards to shore power.

In the Netherlands, ‘Renewable Fuel Units’ (HBEs) are an economic incentive to gradually expand the use of green energy in transport and the reduction of greenhouse gasses. Fossil fuel producers are required to purchase HBEs from green fuel producers. The market is controlled by the Dutch Emission Authority. You can make up to €0.20 per green kWh sold. Learn more about HBEs here.

The Programma Aanpak Stikstof (PAS) is a Dutch law that strictly prohibits the deposition of NOx on environmental protection areas in the Netherlands. Impact on maritime operations can be severe - in particular for wind farm construction - required 80% NOx reduction on top of Tier III restrictions. Learn more about PAS here.

Port of Amsterdam has the ambition to become carbon neutral by 2050 but plans on a zero-emission zone of the inner city by 2025. Learn more about Port of Amsterdam’s sustainable ambitions and shore power here.

Port of Shanghai has the ambition to become carbon neutral by 2060. Learn more about the targets and ambitions of Shanghai with regards to maritime sustainability here.

Port of Hamburg has the ambition to become carbon neutral by 2040. It is one of the most ambitious ports in terms of sustainability in the world and has an installed capacity of 72 MVA of shore power by 2024. Learn more about the targets and ambitions of Port of Hamburg here.

The Ship Energy Efficiency Management Plan II (SEEMP II) is the updated version of the first SEEMP. It includes to obligation of vessels of 5000 GT and above to input CO2 data into the IMO Data Collection System (DCS). Learn more about SEEMP II and how it impacts your vessel’s operations here.

Learn all about the targets, ambitions and upcoming rules and regulations of the Unites Kingdom with regards to maritime sustainability.

Rosneft has the ambition to become carbon neutral by 2050. Learn all more about the targets and ambitions of Rosneft with regards to maritime sustainability here.

Sinopec has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of Sinopec with regards to maritime sustainability here.

PetroChina has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of PetroChina with regards to maritime sustainability here.

Petronas has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of Petronas with regards to maritime sustainability here.

Petrobras has the ambition to become carbon neutral by 2050. Learn all more the targets and ambitions of Petrobras with regards to maritime sustainability here.

The ETD is the principal taxing scheme used for fossil and low-carbon fuels in EU. Fossil fuels will be taxed more, and renewable low-carbon fuels will receive incentives, including shore power.