Fuel and compliance costs for offshore workboat in North Sea

How regulatory costs reshape OPEX and fuel decisions for offshore workboats

Operating an offshore workboat in the North Sea area until 2050 will impose significant financial and operational pressure due to tightening environmental regulations and mounting compliance obligations. The introduction of EU ETS and FuelEU Maritime regulation means that OPEX is not dominated by fuel costs anymore, but increasingly shaped by carbon pricing and regulatory penalties tied to emissions and energy intensity. These policies create a shifting cost landscape that operators need to understand, plan for, and navigate strategically.

Modelling of compliance costs shows a clear tipping point in 2040, with FuelEU Maritime becoming the dominant driver. Although FuelEU currently applies to vessels above 5,000 GT only, its scope may be extended to vessels of 400 GT and above in the future. Results for a large offshore workboat operating year-round in the North Sea, consuming approximately 5,500 metric tons of marine diesel annually, show that the maximum projected cost exposure - under constant EU ETS and fuel price assumptions - could reach up to $250 million between now and 2050. Use the interactive tool to explore the numbers for your own vesse.

-

The Compliance Cost Calculator determines the financial impact of regulations on a vessel’s operations, in particular FuelEU and EU ETS. It calculates compliance costs under business-as-usual conditions and allows for scenario-based assessments of different mitigation strategies, such as switching to alternative fuels, using shore power, or implementing wind-assisted propulsion. This tool helps shipowners, operators, charterers and fleet managers understand their regulatory exposure, quantify penalties, and explore a some cost-saving strategies to maintain compliance while optimizing operational expenses. A report of your analysis can be exported and shared, supporting C-level decision-making, investment strategies, and regulatory reporting. You can use the tool for …

Risk & exposure analysis – Identify cost risks associated with regulatory (non-)compliance and determine the best strategies to reduce financial penalties.

Regulatory compliance assessment – Determine the cost implications of EU ETS and FuelEU Maritime penalties and identify cost-saving strategies.

Investment case report – Create a structured analysis to present cost scenarios and regulatory impacts for 2 ships to decision-makers.

Voyage compliance cost comparison – Project fuel, EU ETS and FuelEU penalties for different voyages instantly - useful for charters.

Lifetime extension analysis – Compare compliance costs for alternative end-of-life dates for the same ship.

-

Only OPEX is considered, CAPEX is excluded in the analysis

The base case is 100% sailing in EU, and thereby maximum EU ETS and FuelEU exposure

Fuel costs are entirely attributed to the shipowner

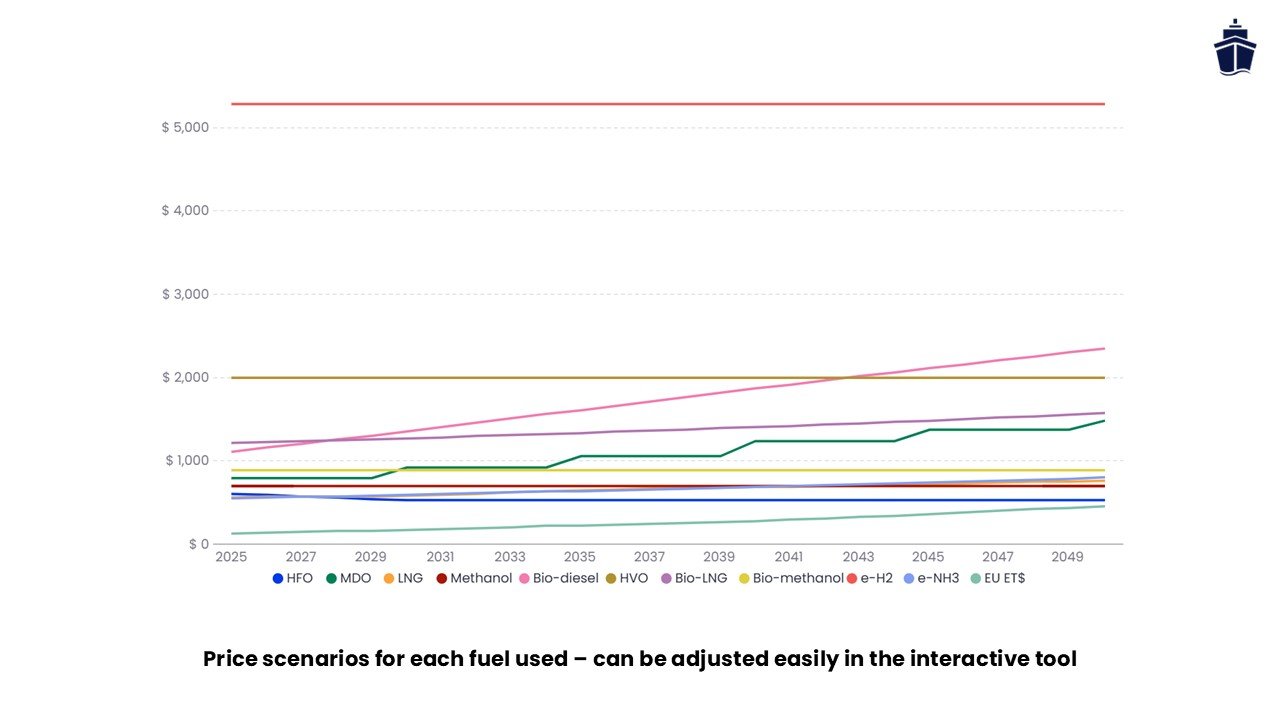

Fuel and EU ETS price projections are fully customizable as per user input but have been assumed constant for analysis base case

Members only

Premium tools and expert support at your fingertips

Don’t want to sign up? Check pay-per-use options

Operating an offshore workboat in the North Sea area until 2050 will impose significant financial and operational pressure due to tightening environmental regulations and mounting compliance obligations. Modelling of compliance costs shows a clear tipping point in 2040, with FuelEU Maritime becoming the dominant driver, although FuelEU currently applies to vessels above 5,000 GT only. Results for a large offshore workboat operating year-round in the North Sea show that the maximum projected cost exposure could reach up to $250 million between now and 2050.